In search of a home is really time intensive and you can choosing the proper mortgage can be vital to buying your house and you will closure on time.

Locating the best virtual assistant financing prices will likely be simple when you learn your credit rating, the way it often apply to your rates and how to enhance your credit score having lower pricing.

Today I can discuss minimal credit score to have a Virtual assistant mortgage, different Va financing pricing by credit rating, and a number of tips about how to improve score and just have recognized to have Va home loans.

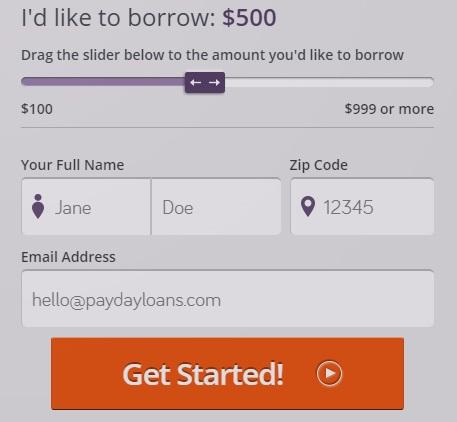

If you’d like to skip the decide to try cost, click the link to check on an educated Va rates together with your current get.

What’s An excellent Virtual assistant Loan?

The new Virtual assistant Mortgage is part of what is known as the GI Costs from Liberties and provides veterans it is able to buy property without any down-payment necessary.

Lowest Credit history Having Va Financing

The minimum credit history getting a beneficial Virtual assistant loan is just about to be accessible an excellent 600. Even if that is rare. Generally speaking you’ll need an effective 640 minimal rating. You can find out exactly how much off financing you can qualify for from the examining Va Finance calculator.

Oftentimes, a great 600 credit history can get you an excellent Virtual assistant loan; however, it will likewise confidence several things:

#step one Your debt-To-Earnings Ratio

The debt-to-earnings ratio welcome having a great Virtual assistant mortgage was 41%, that will be used to know if you can also be eligible for an excellent Virtual assistant mortgage.

Which proportion is actually calculated of the deciding the latest percentage of the terrible monthly income you to definitely would go to your typical month-to-month obligations payments.

State you have got a month-to-month earnings out of $six,100 and all sorts of your own month-to-month loans repayments total up to $dos,000. In such a case, you have got a personal debt-to-income ratio from 33%.

In such a case, even if you provides a reduced credit score for example 600, you happen to be in a position to be eligible for a Virtual assistant financing owed into reduced debt-to-income ratio, even though normally you will want at least a good 640 score.

Other variables are present such as the number of credit lines you possess discover, the down payment, and work background, making it best to explore all of our speed checker lower than to own an accurate price.

#dos Their Borrowing from the bank Character

There’s one or more need you’ll have a 600 credit history. A good Virtual assistant lender are considering the second:

In this case, a Va lender want to see you has actually in the minimum step three trading traces on your borrowing from the bank ahead of several have a tendency to approve your for a financial loan.

This indicates that money is generally stretched slim and may even result in the bank imagine you do not manage to spend off of the financing.

If this sounds like the fact, feel free to rating a totally free estimate less than, and we will reach out to you suggesting if you find yourself ready to implement now or if perhaps steps need earliest be pulled along with your borrowing.

#step three Employment Record

It doesn’t mean you cannot get approved for a financial loan if the you do not have 2 yrs out of a position, however it was more difficult.

Getting a manage into the above three some thing is essential to have you to definitely be capable of geting acknowledged getting an excellent Virtual assistant financing.

Top Va Loan Prices to possess 600 620 Credit history

Eg, a get of 600-620 will qualify for an equivalent rate, however, a rating out-of 621 so you can 640 tend to place you from the a lesser interest rate.

With a credit history ranging from 600 to 620 you will likely feel the second high interest rate for the Virtual assistant supported mortgage.

Since your interest is actually highest, your loan was higher on a month in order to few days foundation and therefore may affect your debt so you’re able to money proportion whether or not it will be used to calculate your own eligibility.

According to financing manager William Caballero, The Virtual assistant constraints the amount of write off things one could pick on the an effective Virtual assistant loan. Oftentimes the new resource isn’t really worth the savings.

As this is possible, you actually wish to purchase having your credit rating higher and never worry about settling any type of things into mortgage.

Your revenue and you will work is going to be keys since a low credit score is seen as a negative about attention of every financial.

Note: In the event your rating is actually low as you have no credit, you still be looking in one rates.

Zero Credit is still handled for example Less than perfect credit in a number of implies so make sure you provides otherwise create no less than step 3 exchange contours with the credit immediately.

With your process, you should be capable assist you for the Virtual assistant Mortgage one to best suits the needs of you and your folks.

Va Home loan Credit history Rate Graph

We need to make you a concept of exactly how much you would-be saving for many who only improved their get from the you to group.

If you decided to bring your rating throughout the low 600’s in order to a 620, you would be saving an additional $29,348 when you look at the money.